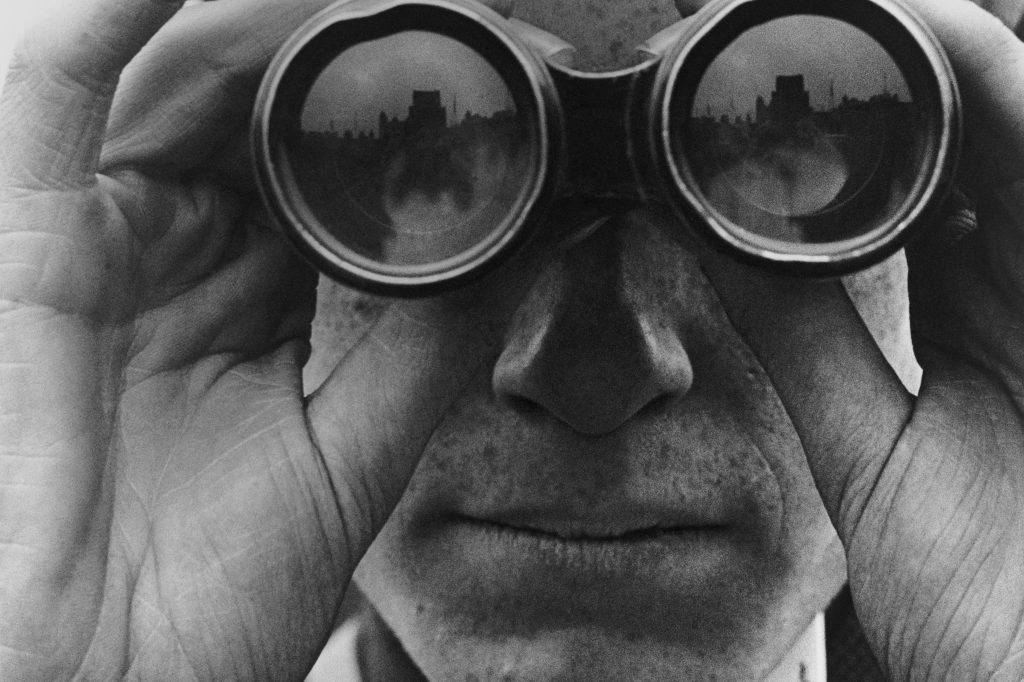

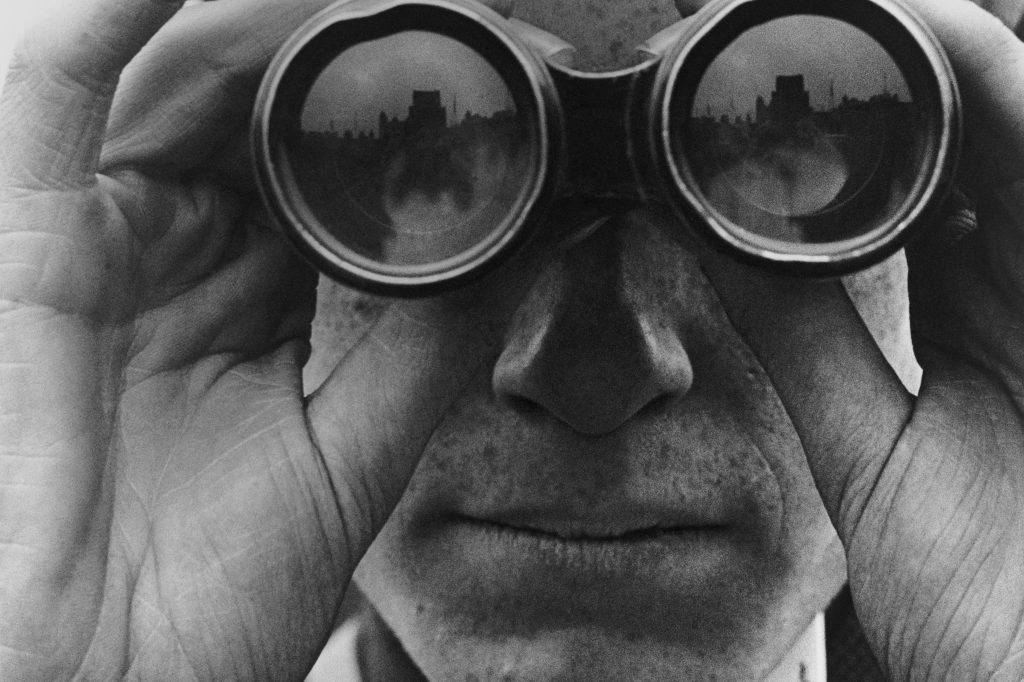

As Wells Fargo fires employees for mouse movers, let's talk about surveillance

A recent FINRA filing indicates that the bank recently terminated some employees for simulating mouse movements at their PCs.

Reporting must take place promptly and not later than 30 days after the firm knows or should have known of the existence of the event.

Reportable events include:

Any associated person is obligated to report to the member firm the existence of any of these events if connected to them.

Statistical and summary information on written customer complaints must be provided to FINRA on a quarterly basis.

The requirements under this rule do not diminish the disclosure responsibilities connected to Forms BD, U4 or U5.

As Wells Fargo fires employees for mouse movers, let's talk about surveillance

A recent FINRA filing indicates that the bank recently terminated some employees for simulating mouse movements at their PCs.

Julie DiMauro4 min read

One-person compliance dept leads to $500,000 fine for online brokerage

Webull fined by Massachusetts regulators for inadequate compliance handling hundreds of thousands of brokerage accounts.

Julie DiMauro6 min read

Onboarding and complaints issues lead to fine and censure for retail investment firm

Webull Financial LLC allegedly incorrectly approved customers for trading and failed to keep tabs on customer complaints.

Thomas Hyrkiel2 min read

Supervision

As Wells Fargo fires employees for mouse movers, let's talk about surveillance

Enforcement

One-person compliance dept leads to $500,000 fine for online brokerage

Enforcement

Onboarding and complaints issues lead to fine and censure for retail investment firm

Disciplinary decisions issued March 29 – April 4, 2025.

Thomas Hyrkiel2 min read

Disciplinary decisions issued August 24 – 30, 2024.

Thomas Hyrkiel2 min read

Disciplinary decisions issued June 29 – July 5, 2024.

Thomas Hyrkiel2 min read

A recent FINRA filing indicates that the bank recently terminated some employees for simulating mouse movements at their PCs.

Julie DiMauro4 min read

Disciplinary decisions issued May 11 – 17, 2024.

Thomas Hyrkiel2 min read

Webull fined by Massachusetts regulators for inadequate compliance handling hundreds of thousands of brokerage accounts.

Julie DiMauro6 min read

Disciplinary decisions issued March 3 - 9, 2023.

Thomas Hyrkiel1 min read

Webull Financial LLC allegedly incorrectly approved customers for trading and failed to keep tabs on customer complaints.

Thomas Hyrkiel2 min read